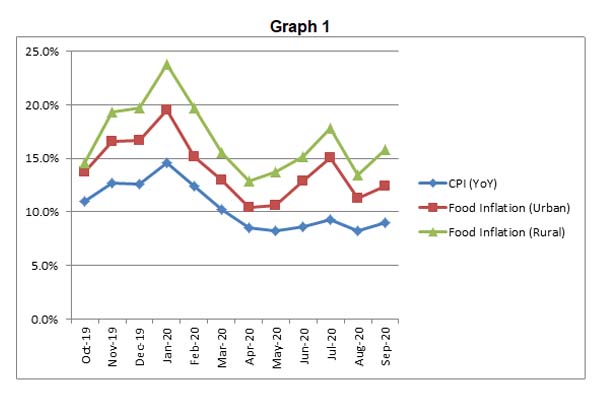

Inflation has soared throughout most of the two-year tenure of the PTI government. What makes it taxing is the fact that elevated food prices remain the noteworthy contributor to this havoc. The average Consumer Price Index (CPI) for the last year remains in double-digits (10.4%) despite a nosedive in aggregate demand during the pandemic. The notable food price hike is evident from a vast difference in CPI and food inflation. The food CPI averages 14% for urban and 16.8% for rural areas in the last one year (see Graph 1).

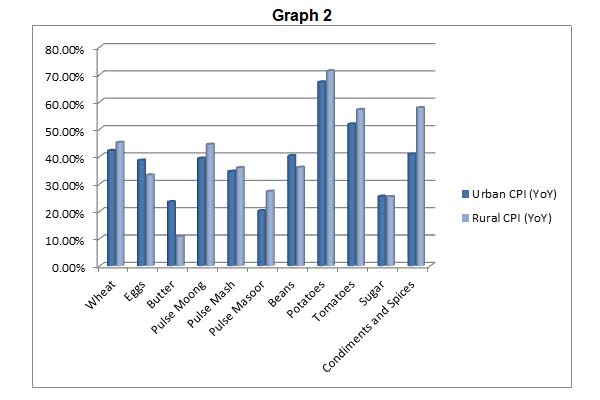

According to the PBS data, price inflation on basic staples like pulses, beans, and vegetables has continued to move upwards. The price of wheat has escalated by 42.1% and 45.1% for urban and rural areas respectively. The pulse mash witnessed a price hike of 34.6% for urban and 35.9% for rural areas, while the price of the pulse masoor rose by 39.3% and 44.4% for urban and rural localities. Other food items that saw burgeoning prices include potatoes (67.2% CPI for urban and 71.3% for rural), tomatoes (51.9% for urban and 57.1% for rural), and spices (40.9% for urban and 57.8% for rural).

The conundrum amplifies for the policymakers when the data highlights a striking disparity in prices between rural and urban centres. The vulnerable bottom of the pyramid, residing in these rural areas, suffers a plunge in their purchasing power in the wake of a much higher rural inflation in most of the essential food items (see Graph 2).

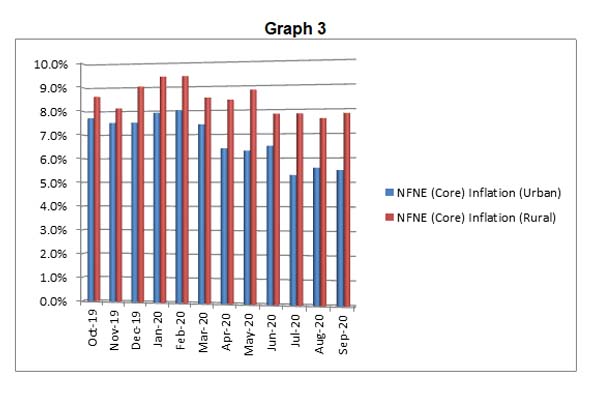

The price differential also prevails in other commodities. The NFNE core inflation averages 6.8% in the last 12 months for urban and 8.5% for the rural areas (see Graph 3).

The recent price hike of 9% in September against 8.2% in August is because of supply chain disruptions. It steers us to the debate on what makes it so arduous for the policymakers to ensure a functional supply chain. The predicament lies in an abysmal administration over commodity prices which results from appalling coordination between federal and provincial authorities. There is nothing much that the country’s central bank can do about this supply-side snag.

Inflation is anticipated to leap further since the IMF has sought an increase in power tariffs. The Economic Coordination Committee (ECC) approved to augment electricity prices by 17% earlier, but the proposal was turned down by the federal cabinet. However, the government will be forced to give in to the IMF’s demands to revive the programme. This will trigger an increase in the policy rate to curb the ramifications of the price hike. Resultantly, there will be an unpropitious impact on the country’s growth with an industrial slump due to a rise in the cost of borrowing. There is a risk that plummeted employment levels will further see a downward spiral when the aggregate demand stagnates (since labour is a derived demand). Besides, the inflation-provoked interest rate increase will also have repercussions on Asia’s best-performing stock market when the investors switch from equities to fixed-income instruments.

Pakistan is at the brink of stagflation with rising inflation amidst modest growth. This situation calls for a joint effort from the federal and provincial governments since provinces have to act as facilitators to the federation to corroborate vigilant price monitoring. It is only possible if the politicians step out of their parochial populist narrative and contemplate the gravity of tis enigma. The policymakers must develop time-sensitive plans to observe the demand-supply scenario in various regions and devise an effective mechanism to distribute commodities across the country equitably. In this way, they can allow the import of goods in case of shortages and permit exports when production is in excess.

Also, they will be able to identify hoarders and effectuate crackdowns to guarantee even supplies for all. This will aid in addressing the regional price disparity. Let us take the example of wheat in this regard. Sindh and Punjab are the two provinces that can produce more wheat than their consumption needs. This surplus has to be channelised to Khyber-Pakhtunkhwa (K-P) and Balochistan, but the wheat producers in Sindh and Punjab hoard to reap the fruit of an artificial price surge. However, there is an expected shortfall in the wheat production this year which is why the cabinet has approved the import of 180,000 tonnes of wheat from Russia.

The policymakers will continue to be blamed for this acute supply-side plight. Hence, they need to beef up administrative efforts in a bid to circumvent this recurring ignominy.

from News Updates From Pakistan - Pakistani News - The Express Tribune https://ift.tt/30WpHb7

https://ift.tt/33XC3BM

No comments:

Post a Comment